Get the coverage you need from

the people you trust

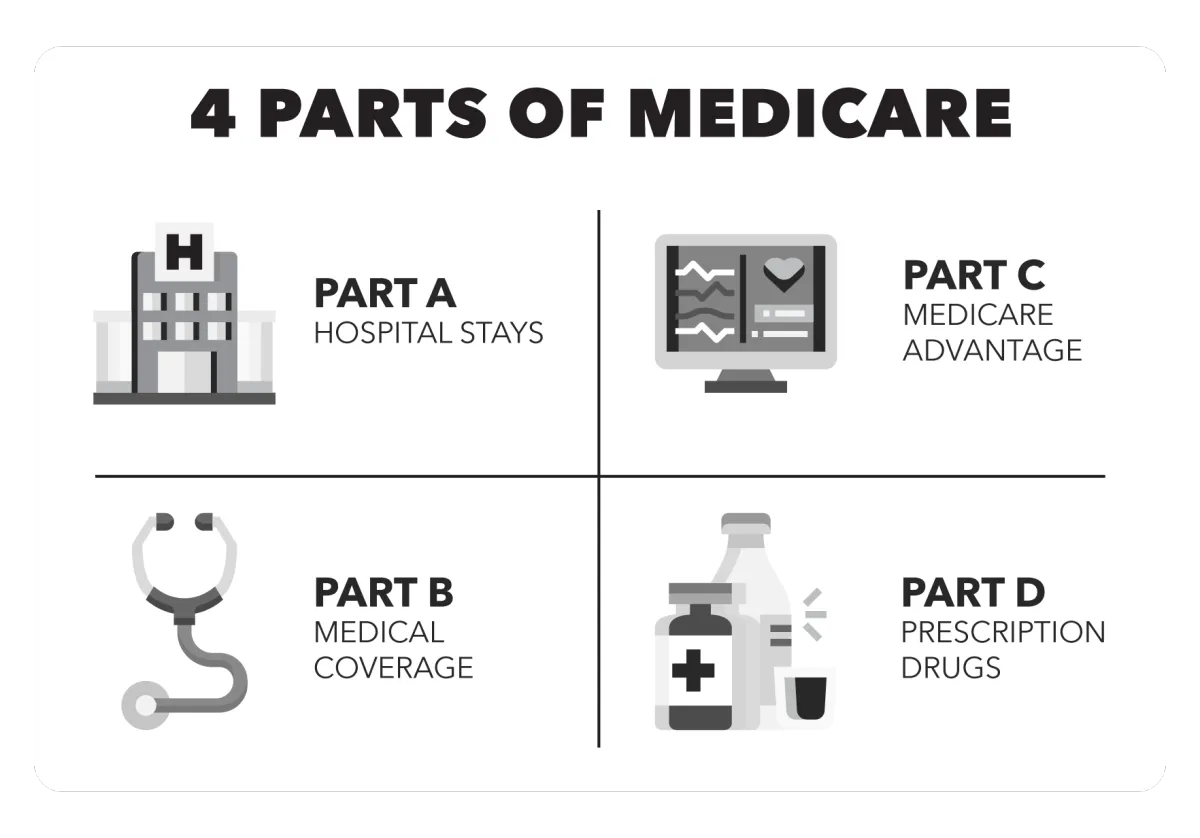

What is Original Medicare?

Original Medicare is the United States’ federal health insurance program for people who are 65 or older. It is also available for certain people younger than 65 with disabilities or people with End-Stage Renal Disease. There are several parts to Medicare that contain different coverage.

What is Part A?

Medicare Part A covers inpatient hospital care, skilled nursing, hospice, surgery, and home healthcare. Deductibles and cost-sharing will apply. Most folks will not have to pay Part A premiums.

What is Part B?

Medicare Part B covers doctor visits, preventative, outpatient services, and lab tests. Deductible and cost-share will apply. Part A and B comprise what is known as “original medicare.”

What is Part C?

Part C, also known as Medicare Advantage, takes the original medicare and privatizes it. In other words, a Medicare Advantage plan bundles Part A, Part B, and usually Part D into one single comprehensive plan with a private carrier.

What is Part D?

Medicare Part D is also known as prescription drug coverage. Part D coverage is available as a Stand Alone Option (PDP) or as part of a Medicare Advantage plan (Part C). Part D plans are offered by private insurance companies contracted and approved by Medicare.

Don't Risk Getting the Wrong Coverage

Let Acadiana Insurance Advisors Help!

We help navigate the confusion of Medicare by providing a "Welcome to Medicare" presentation for our clients explaining Medicare Parts A, B, C and D and the difference of each and what is needed to be covered effectively based on their financial and medical needs.

What are Medicare Supplements?

Medicare Supplement plans, also called Medigap, are designed to work with Original Medicare Parts A and B. Medigap policies help pay for some health care costs not covered by Original Medicare, such as deductibles, coinsurance and foreign travel emergency.

These plans are offered by private insurance companies and are available to people with Medicare Part A and B. People with Original Medicare and a Medicare supplement can choose any stand-alone Part D prescription plans to pay for their drugs. People who are enrolled in Medicare Advantage plans (Part C) are not eligible for a Medicare Supplement insurance policy.

We are not connected with or endorsed by the United States government or the federal Medicare program. We do not offer every plan available in your area, and any information we provide is limited to those plans we do offer in your area. Please get in touch with Medicare.gov or 1-800-MEDICARE to get information on all your options.

Health Insurance sold on acadianainsuranceadvisor.com is processed through the licensed entity: Wise Up Financial, LLC.